Why invest in Continental?

The Equity Story of Continental

Reasons for the speed of the transformation: the world requires more agile, focused and flexible companies to master the ever-changing environment

- Technological transformation, particularly in the Automotive industry

- New competitors and new customers are challenging the status quo, making markets less predictable and changing end consumer demands

- Affordability of products continues to play a major role

- Worldwide supply chains are under pressure with new trade barriers, geopolitical tensions which impact some of the main markets we operate in

- All of our business are impacted by these developments – however to a different extent and that requires tailor-made answers

Continental is undergoing a significant change progress

- Spin-off of AUMOVIO

- ContiTech: Selling OESL, to create an industry pure play – which we are planning to separate in 2026

- Continental will become a pure play Tires company – with a continuously improved business profile

- Resilient tire champion with best-in-class operational efficiency

- Customer-centric business with attractive brand, technology excellence and test-winning products

- Margin and value upside via price/mix opportunities, operational excellence and portfolio management

- Strong cash-generation

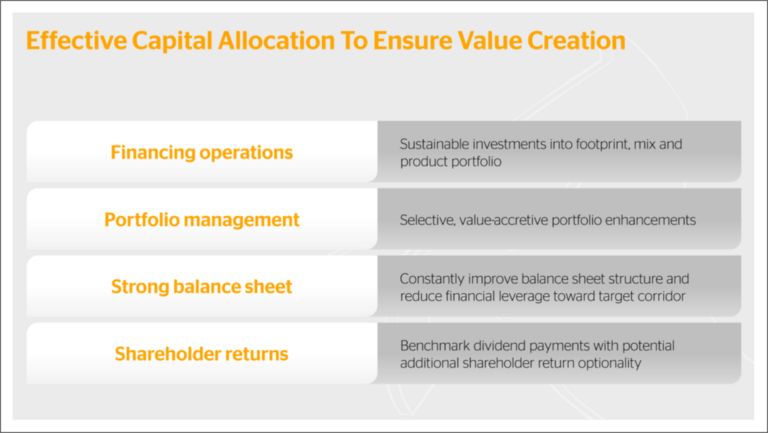

- Sustainable investments into footprint, mix and product portfolio

- Selective, value-accretive portfolio enhancements

- Constantly improve balance sheet structure and reduce financial leverage toward target corridor

- Benchmark dividend payments with potential additional shareholder return optionality

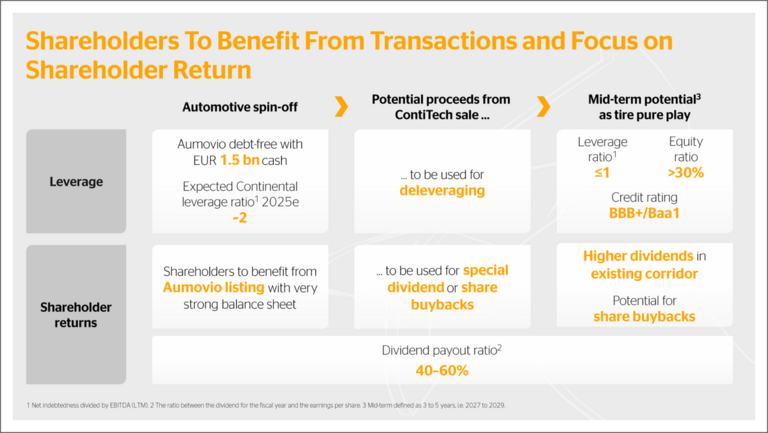

- Dividend payout ratio1 of 40–60%

- We are committed to keep our credit rating at BBB+/Baa1 as a mid-term potential2 as a pure play Tires company

- To keep our leverage ratio3 ≤ 1 in the mid-term2

- To have an equity ratio of more than 30% inn the mid-term2

1The ratio between the dividend for the fiscal year and the earnings per share

2Mid-term defined as 3 to 5 years, i.e. 2027 to 2029

3Net indebtedness divided by EBITDA (LTM)

CLEAR AMBITION

We strive for …

- Carbon neutrality along the entire value chain

- Emission-free mobility & industry (no harmful emissions)

- Circular economy

- Responsible value chains

- by 2050 at the latest

- together with our value chain partners and matching the speed of our customers, industries and markets.

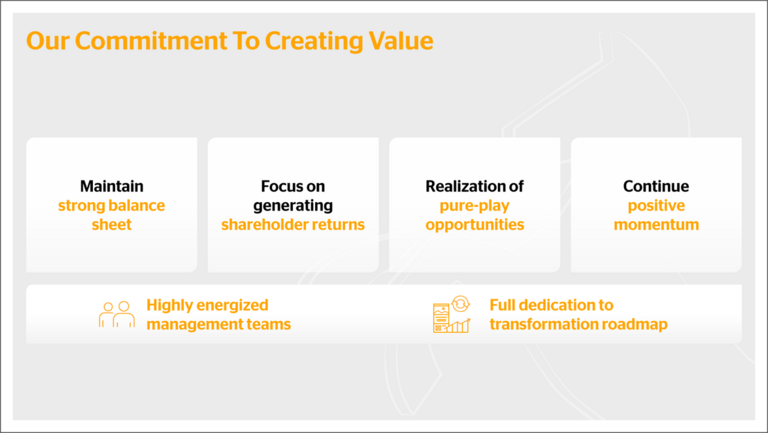

- Maintain strong balance sheet

- Focus on generating shareholder returns

- Realization of pure-play opportunities

- Continue positive momentum