Continental Makes a Solid Start to the Year

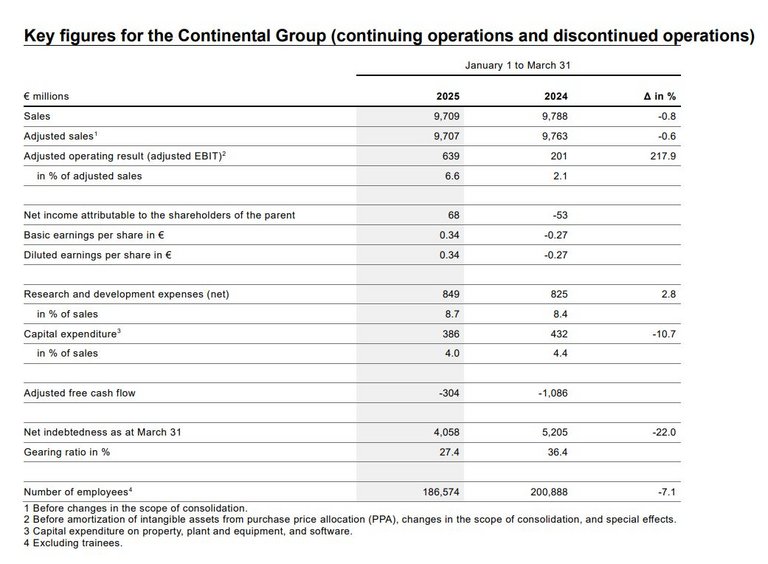

- Consolidated sales of €9.7 billion (Q1 2024: €9.8 billion, -0.8 percent)

- Planned Automotive spin-off has led to mandatory application of IFRS 5 accounting standard

- Adjusted EBIT of €639 million; without application of IFRS 5, adjusted EBIT would have been €586 million (Q1 2024: €201 million)

- Adjusted EBIT margin of 6.6 percent; without application of IFRS 5, adjusted EBIT margin would have been 6.0 percent (Q1 2024: 2.1 percent)

- Net income of €68 million (Q1 2024: -€53 million)

- Adjusted free cash flow of -€304 million (Q1 2024: -€1.1 billion)

- CEO Nikolai Setzer: “We made a solid start to the year, significantly improving our earnings for the Continental Group in the first quarter compared with 2024, and are confident that we will achieve our annual targets”

- CFO Olaf Schick: “The quarterly results reflect our focus on improving our financial position – and show that our efficiency measures are paying off”

- Outlook for fiscal 2025 is separate for Automotive due to spin-off

Hanover, Germany, May 6, 2025. Continental made a solid start to the year. As expected, its first quarter of 2025 was significantly better than its first quarter of 2024. Despite declining automotive production in Europe and North America, the Automotive group sector achieved significantly higher earnings year-on-year. Tires also recorded a strong improvement in earnings in the first quarter. ContiTech posted an adjusted operating result roughly on a par with the previous year despite weak industrial demand. Geopolitical tensions and the potential impact of trade restrictions are causing a high degree of uncertainty about global economic development in the current fiscal year.

“We made a solid start to the year, significantly improving our earnings for the Continental Group in the first quarter compared with 2024, and are confident that we will achieve our annual targets,” said Continental CEO Nikolai Setzer in Hanover on Tuesday.

Operating result significantly increased

In the first quarter of 2025, Continental achieved consolidated sales of €9.7 billion (Q1 2024: €9.8 billion, -0.8 percent). Its adjusted operating result increased to €639 million, corresponding to an adjusted EBIT margin of 6.6 percent. Without the application of IFRS 5, the adjusted operating result would have been €586 million (Q1 2024: €201 million) and the adjusted EBIT margin would have been 6.0 percent (Q1 2024: 2.1 percent). Due to the planned spin-off of the Automotive group sector, the accounting standard IFRS 5 (Non-current Assets Held for Sale and Discontinued Operations) has been applied as required. Consequently, since the Supervisory Board approved the spin-off on March 12, 2025, depreciation on those parts of the business earmarked for spin-off has no longer been taken into account.

Net income in the first quarter was €68 million (Q1 2024: -€53 million). Adjusted free cash flow was significantly higher than in the previous year but, due to the seasonal nature of the business, was still negative at -€304 million (Q1 2024: -€1.1 billion).

“The quarterly results reflect our focus on improving our financial position – and show that our efficiency measures are paying off. This is evident not only in earnings, but also in free cash flow, which was likewise up sharply year-on-year,” said Continental CFO Olaf Schick.

Global automotive production slightly higher year-on-year

In the first quarter of 2025, the global production of passenger cars and light commercial vehicles was slightly higher year-on-year, improving by around 1 percent to 21.7 million units (Q1 2024: 21.4 million units).

In Europe, however, automotive production declined significantly by 7 percent year-on-year to around 4.2 million units. The trend in North America was similar, with a decline of 5 percent to 3.8 million vehicles. China, by contrast, recorded an increase of more than 11 percent to 6.9 million units. Weighted for regional sales of the Automotive group sector, global automotive production was therefore down 3 percent.

Outlook for fiscal 2025 is separate for Automotive due to spin-off

In light of the planned spin-off, Continental’s outlook covers the continuing operations of the Tires and ContiTech group sectors. The Automotive group sector is reported separately as a discontinued operation. The forecasts for sales and adjusted EBIT margin for the individual Automotive, Tires and ContiTech group sectors remain unchanged.

The outlook for the year does not take into account any potential impact resulting from possible future trade restrictions.

Based on assumptions regarding business development as well as average exchange rates in the first quarter, Continental expects the following key figures.

For the continuing operations of Tires and ContiTech:

Continental expects consolidated sales in the range of around €19.5 billion to €21.0 billion and an adjusted EBIT margin of around 10.5 to 11.5 percent.

For the Tires group sector, Continental forecasts sales of around €13.5 billion to €14.5 billion and an adjusted EBIT margin of around 13.3 to 14.3 percent.

Continental anticipates sales in the ContiTech group sector of around €6.3 billion to €6.8 billion and an adjusted EBIT margin of around 6.0 to 7.0 percent.

Capital expenditure before financial investments is forecast to be around 6.0 percent of sales.

Adjusted free cash flow is expected to be around €0.6 billion to €1.0 billion.

For the discontinued operations of the Automotive group sector, Continental expects sales of around €18.0 billion to €20.0 billion and an adjusted EBIT margin of around 2.5 to 4.0 percent, operationally unchanged and excluding the effects of IFRS 5.

Automotive: significant improvement year-on-year

In the Automotive group sector, sales fell by just 1.2 percent to €4.8 billion (Q1 2024: €4.8 billion) despite sharply declining markets in Europe and North America. Before exchange-rate effects and changes in the scope of consolidation, it posted organic sales growth of 0.4 percent. However, the adjusted EBIT margin was up sharply at 2.8 percent. Without the application of IFRS 5, the adjusted EBIT margin would have been 1.6 percent (Q1 2024: -4.0 percent).

The year-on-year improvement was due in large part to the rigorous implementation of measures to reduce costs and sustained price adjustments.

In the past quarter, Continental received major orders for radar sensors from North American customers with a combined volume of around €1.5 billion. In total, the Automotive group sector recorded an order intake of around €5.8 billion in the first quarter of 2025.

Tires: strong improvement in earnings at the start of the year

The Tires group sector performed well in the first quarter, generating sales of €3.4 billion (Q1 2024: €3.3 billion, +3.7 percent). At 13.4 percent, its adjusted EBIT margin was significantly higher than in the previous year (Q1 2024: 11.7 percent). This was primarily due to a good start to the year in the replacement-tire business across all regions.

At the beginning of March, Continental was also named “Tire Manufacturer of the Year” at this year’s Tire Technology International Awards for Innovation and Excellence. The jury was impressed by Continental’s ongoing efforts in its field, including increasing the share of sustainable materials at its plants, implementing the highest energy efficiency standards and obtaining international sustainability certifications at various locations.

Sustainability and top quality go hand in hand at Continental, as evidenced by the rating of “outstanding” awarded to the UltraContact NXT by the magazine auto motor und sport in its 2025 ranking of the best sustainable, fuel-saving summer tires. In fact, Continental’s summer tires again received a number of accolades for the current season, with the associations ADAC (Germany), ÖAMTC (Austria) and TCS (Switzerland) each awarding the SportContact 7 top ratings. Auto Bild rated the tire as “exemplary,” while sport auto gave the SportContact 7 the rating “outstanding” as it took top spot in the magazine’s independent tire test.

ContiTech: earnings margin on a par with the previous year

In a challenging market environment characterized by weak industrial demand, especially in Europe, the ContiTech group sector posted sales of €1.5 billion in the first quarter (Q1 2024: €1.6 billion, -6.7 percent). Its adjusted EBIT margin was 5.4 percent (Q1 2024: 5.3 percent). Its earnings margin was thus on a par with the previous year despite the market situation. Continental expects earnings to improve in the course of the year due to the measures taken to reduce costs and an anticipated increase in industrial demand in the second half of 2025.

Continental also recently launched a new production line for hydrogen hoses at its location in Korbach, Germany. The production facility, which cost around €3 million, will enable ContiTech to offer safe and efficient solutions along the entire hydrogen value chain. These range from the production and transportation of hydrogen through to its distribution and use in fuel cells and the refueling of cars, trucks, ships and aircraft.

Overview of all available materials: Results Q1 | 2025