Continental Reaches Key Milestones in Its Realignment

Q3 2025 Results

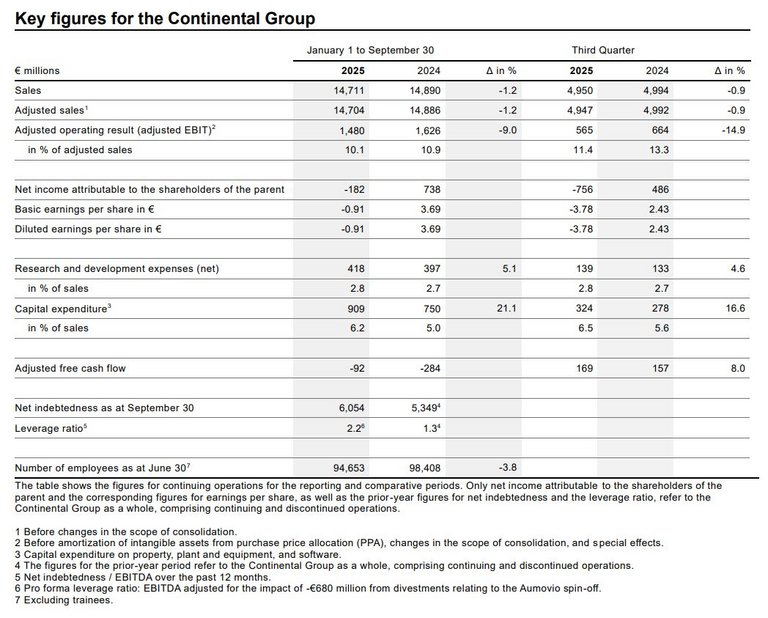

- Consolidated sales of €5.0 billion (Q3 2024: €5.0 billion, -0.9 percent); organic growth of 2.6 percent

- Adjusted EBIT of €565 million (Q3 2024: €664 million, -14.9 percent); prior-year earnings boosted by one-time effect

- Adjusted EBIT margin of 11.4 percent (Q3 2024: 13.3 percent)

- Spin-off of Aumovio successfully completed; OESL sale contractually agreed

- Aumovio spin-off and planned OESL sale lead to negative impact on earnings from non-cash special effects in the amount of €1.1 billion

- Net income of -€756 million (Q3 2024: €486 million)

- Adjusted free cash flow of €169 million (Q3 2024: €157 million, +8.0 percent)

- CEO Nikolai Setzer: “In a challenging market environment, we continue to work diligently, both operationally and strategically, to complete our realignment next year”

- CFO Roland Welzbacher: “Tires, ContiTech and free cash flow all showed significant improvement compared with the second quarter. Looking ahead to the final quarter of the year, we are aiming for further improvements in cash flow and at ContiTech”

Hanover, Germany, November 6, 2025. Continental reached key milestones in its realignment during the past quarter. As planned, the company swiftly completed the spin-off of Aumovio and signed the agreement to sell its Original Equipment Solutions (OESL) business area. The final steps of the realignment include the sale of ContiTech next year and a sharpened focus on Continental’s tire business.

Continental’s operational performance in the third quarter of 2025 was affected by challenging market conditions driven by the general economic uncertainty. In this environment, the Tires group sector achieved good results and significantly improved compared with the second quarter of 2025, thanks to the strong replacement-tire business for passenger cars, particularly in North America and Asia. Despite weak industrial demand, ContiTech increased its adjusted EBIT margin year-on-year thanks to short-term cost-reduction measures. However, non-cash special effects from the Aumovio spin-off and the planned OESL sale overshadowed the otherwise solid operational performance in both EBIT and net income at group level.

“In the third quarter, we successfully reached key strategic milestones in our realignment. The agreement to sell our Original Equipment Solutions business area and the spin-off of Aumovio bring us significantly closer to our goal of positioning Continental as a focused tire champion and ContiTech as an independent industrial specialist. Both have substantial value creation potential in their respective sectors. In a challenging market environment, we continue to work diligently, both operationally and strategically, to complete our realignment next year,” said Continental CEO Nikolai Setzer in Hanover on Thursday.

Consolidated sales of €5.0 billion

In the third quarter of 2025, Continental achieved consolidated sales of €5.0 billion (Q3 2024: €5.0 billion, -0.9 percent). Before exchange-rate effects and changes in the scope of consolidation, it posted organic sales growth of 2.6 percent. Its adjusted operating result was €565 million (Q3 2024: €664 million, -14.9 percent). In the prior-year quarter, adjusted EBIT was significantly boosted by a one-time effect at group level (a €125 million payment from Vitesco Technologies to Continental). The adjusted EBIT margin was 11.4 percent (Q3 2024: 13.3 percent). Due to the planned sale of the OESL business area, the accounting standard IFRS 5 (Non-current Assets Held for Sale and Discontinued Operations) has been applied as required. Therefore, since the Supervisory Board’s approval on August 26, 2025, no depreciation has been recognized in the business operation earmarked for sale. Without the application of IFRS 5, the adjusted operating result would have been €558 million and the adjusted EBIT margin would have been 11.3 percent.

Net income in the third quarter amounted to -€756 million (Q3 2024: €486 million). Non-cash special effects from the Aumovio spin-off and the planned OESL sale had a negative impact of €1.1 billion on EBIT. These special effects stem from currency translation differences due to the disposal of foreign subsidiaries as part of the Aumovio spin-off, as well as the difference between the net assets of OESL and the expected sale price. The effects also negatively impacted net income. They are excluded from adjusted EBIT and are non-cash, meaning they do not affect cash flow. The dividend policy also allows for these non-cash special effects to be excluded from net income when calculating the dividend proposal.

Adjusted free cash flow was up slightly year-on-year at €169 million (Q3 2024: €157 million, +8.0 percent).

“Our financial performance in the third quarter was shaped by one-time special effects resulting from our strategic realignment. Tires, ContiTech and free cash flow all showed significant improvement compared with the second quarter. Looking ahead to the final quarter of the year, we are aiming for further improvements in cash flow and at ContiTech. Our strict cost discipline will support us in this effort, as will an expected slight recovery in industrial demand,” said Continental CFO Roland Welzbacher.

Subdued economic activity in key markets

Continental’s key markets faced a challenging economic environment in the third quarter of 2025, reflected in an overall slowdown in economic momentum. The European replacement-tire market for passenger cars and light commercial vehicles, which is important for Continental, declined by 2 percent. European industrial production rose slightly by 1.4 percent from a low base, while US industrial production increased by 1.1 percent compared with the same quarter last year. Global production of passenger cars and light commercial vehicles rose by around 4 percent to 22.6 million units.

Tires: strong replacement-tire business

The Tires group sector recorded sales of €3.5 billion in the third quarter (Q3 2024: €3.5 billion, +0.0 percent). Before exchange-rate effects and changes in the scope of consolidation, it posted organic sales growth of 3.6 percent. The adjusted EBIT margin was significantly higher than in the second quarter of 2025 (Q2 2025: 12.0 percent), reaching 14.3 percent in the third quarter (Q3 2024: 14.6 percent). Exchange-rate effects and tariffs on imports into the USA had a negative impact. Nevertheless, Continental saw strong results in the replacement-tire business for passenger cars in North America and Asia in the third quarter.

The winter tire season also got off to a successful start, thanks in large part to the quality of Continental’s award-winning products. The WinterContact TS 870 P was the winner in the latest auto, motor und sport winter tire test. The German automobile magazine highlighted its reliability and safety on snow, outstanding grip for short braking distances and excellent cornering performance. The expert jury at Reifentester was impressed by the tire’s performance in wet and dry conditions, awarding it the top spot. Drivers opting for all-season tires this time of year are also in good hands with Continental. The AllSeasonContact 2 took first place in the tire test conducted by the Automobilclub von Deutschland (AvD), earning top marks on both dry and wet surfaces.

In addition to high quality, Continental is committed to sustainability. Comprising up to 65 percent renewable, recycled and mass-balance-certified materials, the UltraContact NXT combines sustainability with maximum safety and performance. Since its launch, it has won numerous industry awards, most recently receiving the “2025 BEST OF mobility” award at IAA MOBILITY. Continental is now bringing this innovation to the commercial vehicle segment with the launch of the Conti Urban HA 5 NXT, marking a new era in sustainable urban mobility. Notably, the bus tire contains up to 60 percent renewable, recycled and mass-balance-certified materials. With a 25 percent reduction in rolling resistance, it enables more efficient operation of electric buses and can increase range by up to 15 percent. The new city bus tire helps fleet operators and vehicle manufacturers meet both ecological and operational requirements.

Continental is actively expanding the use of renewable and recycled materials in its tire production. In 2024, their share averaged 26 percent. By 2030, the target is at least 40 percent. To achieve this, Continental uses synthetic rubber made from used cooking oil and silica derived from rice husk ash.

ContiTech: improvement year-on-year

The ContiTech group sector achieved sales of €1.5 billion in the third quarter of 2025 (Q3 2024: €1.5 billion, -3.7 percent). Before exchange-rate effects and changes in the scope of consolidation, its organic sales were down 0.6 percent. Despite declining industrial demand, ContiTech achieved an adjusted EBIT margin of 6.6 percent, an improvement year-on-year, thanks to short-term cost-reduction measures. Even without the impact of IFRS 5, its adjusted EBIT margin would have improved to 6.1 percent (Q3 2024: 4.4 percent). Looking ahead to the seasonally stronger fourth quarter, ContiTech aims to further improve results through continued cost discipline, a better product mix and increased demand.

To best serve local customer demand, ContiTech plans to invest more than $85 million in its Mount Pleasant location in Iowa, USA. The investment will fund the construction of a new mixing facility for producing rubber compounds used in industrial hose and belt manufacturing. Such a facility is a key component in the rubber processing production chain. Mount Pleasant is one of more than 20 ContiTech locations across the USA.

ContiTech once again demonstrated its expertise in future technologies during the past quarter. The group sector is involved in one of the first European carbon capture and storage projects in the North Sea, supplying an approximately 430-meter high-pressure hose for the injection and storage of liquid CO2 in deep geological formations. The high-pressure hose meets particularly high material requirements due to weather conditions and internal pressure of 200 bar – about 27 times the tire pressure of the Conti Urban.

ContiTech has also entered into a strategic partnership with AQP Industrial Service to support the mining industry in Peru with comprehensive conveying solutions. ContiTech will supply conveyor belts as well as complete systems comprising components, sensors and services for efficient, safe and sustainable material transport. AQP will handle installation, maintenance and on-site repairs, contributing 28 years of local industry experience. Together, the two companies aim to improve operational processes and reduce downtime in demanding environments.

Overview of all available materials: Results 9M | 2025