What Drives People When Mobility Changes?

What are the challenges facing electric mobility? How much do people trust automated and autonomous driving? And how important is it in life to have your own vehicle? Since 2011, our biennial representative mobility studies have documented people’s attitudes, expectations and concerns on the topic of transport and mobility. What originally began as a snapshot of driving sentiment has since evolved into a barometer for mobility trends. Our studies are now among the most comprehensive of their kind, regularly surveying drivers in countries including Germany, France, China and the USA. Below are the five most important findings.

What Drives People When Mobility Changes?

What are the challenges facing electric mobility? How much do people trust automated and autonomous driving? And how important is it in life to have your own vehicle? Since 2011, our biennial representative mobility studies have documented people’s attitudes, expectations and concerns on the topic of transport and mobility. What originally began as a snapshot of driving sentiment has since evolved into a barometer for mobility trends. Our studies are now among the most comprehensive of their kind, regularly surveying drivers in countries including Germany, France, China and the USA. Below are the five most important findings.

1. Electric mobility: from reservations to readiness to buy

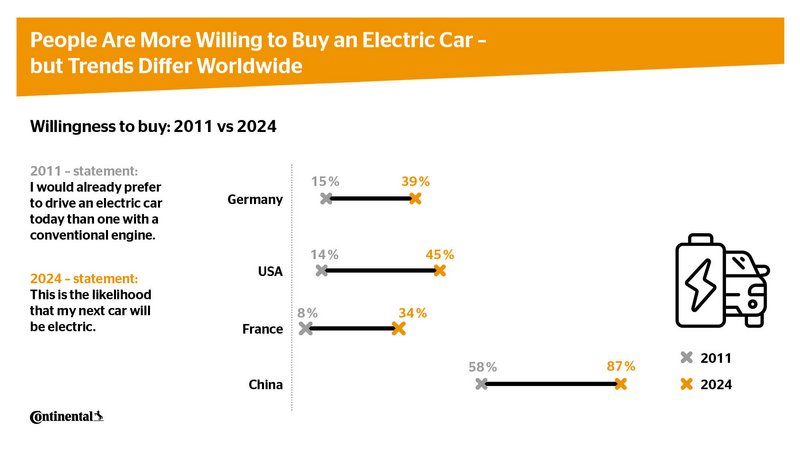

Few mobility topics have stirred as much debate in recent years as the switch to electric vehicles. While drivers have been open to the new technology from the start, at the beginning of the 2010s people in Germany, France and the USA were still hesitant to actually purchase an electric car. China was a notable exception: our 2011 study showed significantly higher purchase intent there.

Among skeptics, range anxiety dominated the conversation. In 2011, three out of four respondents in Germany and half in the USA said they would not want to charge their car every 150 kilometers – even though 90 percent reported driving less than 100 kilometers a day.

Another major barrier was the high cost of electric cars. By 2015, fewer drivers across all age groups expected to be driving a fully electric vehicle within four to ten years. Despite their eco-friendly image, electric vehicles still lacked emotional appeal.

By 2020, the divide had become a chasm: in Germany and France, for example, only one-third of respondents could imagine buying an electric car, while in China the proportion of drivers open to the idea had risen to 86 percent. Cost was also a much smaller concern in China than elsewhere. This trend continued into 2022, with eight out of 10 Chinese respondents still planning to buy an electric vehicle next. Meanwhile, skepticism persisted in other countries. By 2024, the gap had begun to narrow: in China, only half of Chinese electric vehicle enthusiasts still believed they would purchase one soon – primarily due to cost. In other countries, willingness increased slightly, and calls for government subsidies grew louder. Clearly, electric mobility still needs a global boost to play a more pivotal role in the future of transportation.

2. Hybrid vehicles: from positive reputation to stable bridge technology

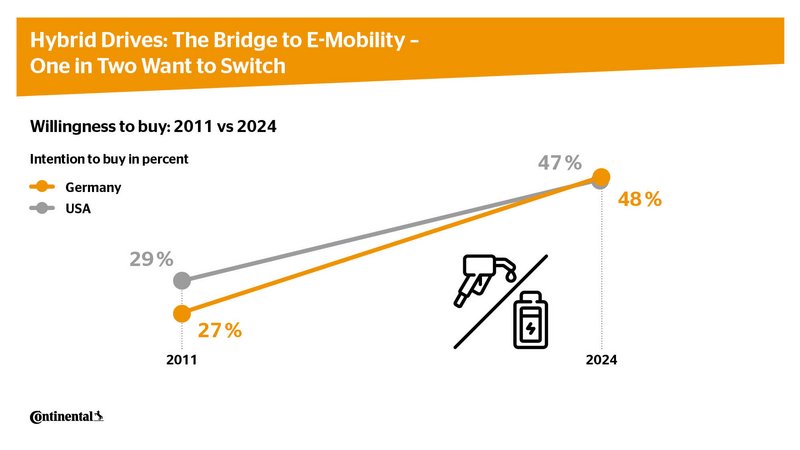

Hybrid drives already had a solid reputation at the beginning of the 2010s. “Of the 96 percent of German respondents familiar with this resource-efficient technology, 27 percent will probably or definitely purchase a hybrid vehicle,” concluded our 2011 mobility study. The technology continued to gain traction across countries in subsequent years. By 2024, nearly half of respondents in Germany and the USA said they could imagine buying a hybrid vehicle next. Our studies show that hybrids remain a key part of the mobility transition, continuing to serve as a vital bridge to electric mobility.

3. Automated driving: from skepticism to anticipation

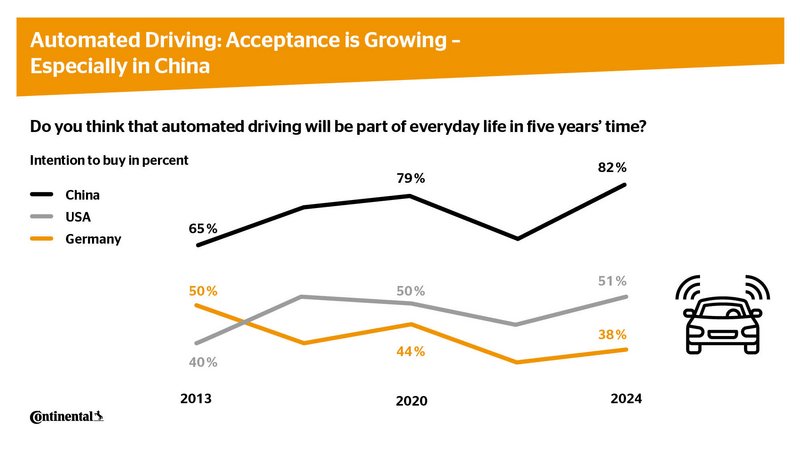

Letting go of control is difficult for many – and that is reflected in attitudes toward automated driving. Yet our earlier studies reveal that most drivers were open to the concept. Even 12 years ago, many saw value in automation, especially for long highway drives and traffic jams. Our 2015 study confirmed strong interest in automation and connectivity, with more than two-thirds of drivers in Germany and the majority in the USA saying they would welcome automated driving, especially in stressful or monotonous situations. This trend continued in 2018. However, our 2020 study found that most people still preferred to drive themselves and could not yet imagine giving up control – especially in France, Germany and the USA. Many also cited the lack of legal frameworks to support the technology.

Just four years later, our 2024 mobility study showed a “clearly positive attitude to highly automated and autonomous driving,” especially among drivers aged 25 to 34. They looked forward to new in-car activities like reading, gaming or working while the vehicle drove itself.

4. Autonomous trucks: from vision to desired solution

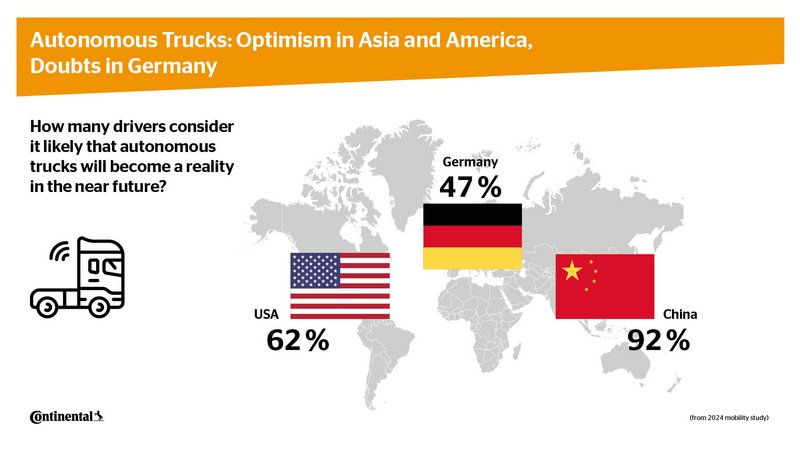

In 2016, autonomous driving in logistics still seemed like a distant vision. Only a quarter of German logistics professionals saw its potential. Eight years later, even people outside the industry believed driverless trucks could soon become reality. This was confirmed by our 2024 mobility study, which found that nearly half of respondents in Germany considered autonomous trucks likely in the near future. In the USA, nearly two-thirds agreed – and in China, a striking 92 percent. Around 60 percent of German respondents saw them as a solution to the driver shortage in transport companies. Nearly half believed autonomous trucks could improve traffic flow on highways and reduce congestion. Still, our study also revealed that safety concerns remain widespread across the globe.

5. Personal vehicles: essential tool and status symbol for young people

Our 2011 study showed that owning a car was very important to eight out of 10 respondents in Germany, France, China and the USA. Four years later, 83 percent of vehicles in Germany were privately owned. For most 18- to 30-year-olds, a personal car remained the top choice over public transport and car sharing. The pandemic reinforced this trend toward individual mobility, and for many people the car became an even more important personal space and refuge.

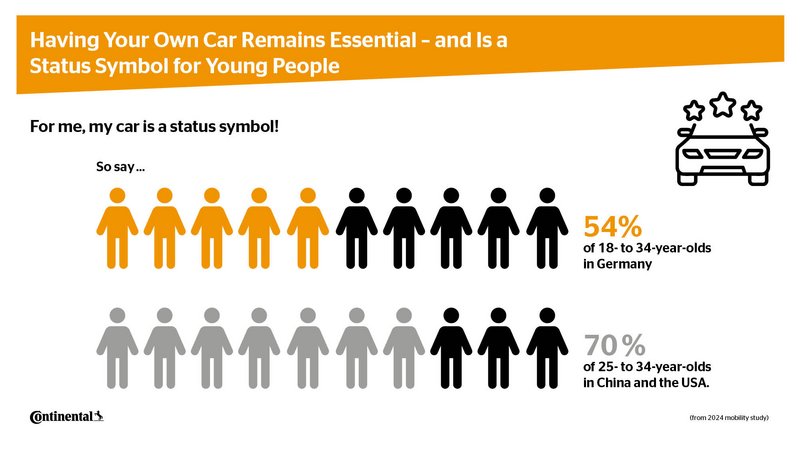

This development was confirmed by our 2022 study: the vast majority of households in all surveyed countries owned at least one car. Households without a car were especially rare in France and the USA. The trend continued in 2024: across all countries, nine out of 10 car owners said that having their own car was essential for shopping and other errands. Added to this, the majority of young German drivers up to age 34 regarded having their own car as a status symbol. Contrary to popular belief, vehicle ownership is not declining in favor of car sharing or alternative mobility concepts. Driving and owning a car remains a fundamental need for many people.

Continental’s mobility studies from 2011 to 2024 not only reveal where transport and mobility are headed – they also offer insights into what truly drives people when mobility itself changes.

Here you will find mobility studies from 2011 to 2024.