After a Weak Start: Continental Confirms Its Full-year Outlook

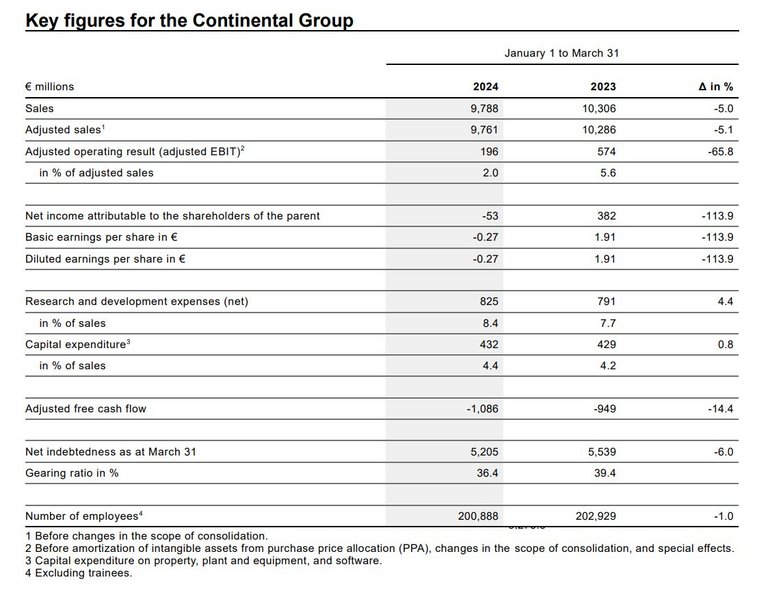

- Consolidated sales of €9.8 billion (Q1 2023: €10.3 billion, -5.0 percent)

- Adjusted EBIT of €196 million (Q1 2023: €574 million, -65.8 percent)

- Adjusted EBIT margin of 2.0 percent (Q1 2023: 5.6 percent)

- Net income of -€53 million (Q1 2023: €382 million, -113.9 percent)

- Adjusted free cash flow of -€1.1 billion (Q1 2023: -€949 million, -14.4 percent)

- CEO Nikolai Setzer: “We are pursuing our goals resolutely and sustainably. We are on track with the implementation of our measures to achieve our mid-term targets. And in 2024 we will be taking another step forward”

- CFO Katja Garcia Vila: “Despite the weak first quarter, we see sufficient potential for improvement across all group sectors, which is why we are confirming our outlook for fiscal 2024”

- Automotive: start of production of new high-performance computer in China

- Tires: serial test winner

Hanover, May 8, 2024. After a weak first quarter in 2024, Continental expects earnings to improve as the year progresses – particularly in the second half of the year. Based on this, the DAX company is confirming its full-year outlook, as already announced together with the publication of its key figures for the first quarter on April 16, 2024. Overall, Continental still anticipates consolidated sales for 2024 of around €41.0 billion to €44.0 billion and an adjusted EBIT margin of around 6.0 to 7.0 percent.

“We are pursuing our goals resolutely and sustainably. We are on track with the implementation of our measures to achieve our mid-term targets. And in 2024 we will be taking a another step forward. The first quarter will be our weakest this year. As the year progresses, we will see improvements across the three group sectors Automotive, Tires and ContiTech,” Continental CEO Nikolai Setzer said in Hanover, Germany, on Wednesday.

Consolidated sales in the first quarter of €9.8 billion – adjusted EBIT margin of 2.0 percent

In the first quarter of 2024, Continental achieved consolidated sales of €9.8 billion (Q1 2023: €10.3 billion, -5.0 percent). Its adjusted operating result was €196 million (Q1 2023: €574 million, -65.8 percent), corresponding to an adjusted EBIT margin of 2.0 percent (Q1 2023: 5.6 percent).

Net income in the first quarter amounted to -€53 million (Q1 2023: €382 million, -113.9 percent). Adjustedfreecash flow was -€1.1 billion (Q1 2023: -€949 million).

“As announced, adjusted free cash flow in the first quarter was heavily impacted by the €500 million payment for the buyback of shares in ContiTech AG. For the year as a whole, we still anticipate adjusted free cash flow of around €0.7 billion to €1.1 billion,” said Continental CFO Katja Garcia Vila, adding: “Despite the weak first quarter, we see sufficient potential for improvement across all group sectors, which is why we are confirming our outlook for fiscal 2024.”

Slight decline in automotive production in the first quarter of 2024

At the start of the year, the global production of passenger cars and light commercial vehicles recorded a slight decline year-on-year, falling by around 1 percent compared with the first quarter of 2023 to 21.2 million units (Q1 2023: 21.4 million units).

Vehicle production in Continental’s core market of Europe, in particular, was weaker from January to March 2024 than in the prior-year period, at around 4.4 million units (-3 percent). In North America, production rose slightly to around 3.9 million vehicles (+1 percent). China had a good start to the year, producing around 6.1 million vehicles in the first quarter of 2024, up 4 percent year-on-year.

For the year as a whole, Continental still expects global passenger car and light commercial vehicle production to be roughly on par with the previous year, trending in a range of -1 to +1 percent.

Automotive: start of production of another high-performance computer

In the Automotive group sector, sales decreased by 4.0 percent to €4.8 billion (Q1 2023: €5.0 billion). Its adjusted EBIT margin was down year-on-year at -4.3 percent (Q1 2023: 0.8 percent). This was mainly due to lower production volumes, especially in Europe, as well as pending agreements from price negotiations with automotive manufacturers. Delayed product launches, weak business in North America and exchange-rate effects also had a negative impact, while salary increases hampered profitability. As the year progresses, price adjustments, initial savings from cost-cutting measures and efficiency improvements will lead to an increase in earnings.

Continental technologies continue to be in high demand. The first quarter of 2024, for instance, saw the start of production of another high-performance computer for a Chinese automotive manufacturer. This high-performance computer acts as the vehicle’s central nervous system, integrating features for body and vehicle control, as well as data communication management, over-the-air updates, and torque and thermal management. It also communicates with features from other vehicle domains, such as those for assisted and automated driving and from the cockpit.

Furthermore, Continental has received numerous orders for future technologies, including an order of over €1.5 billion for its radar sensors. Here, a long-range radar with focused sensor systems for maximum range and precision will be combined with multiple surround radar sensors. All of this maximizes safety and convenience when driving. With 360° radar coverage and a 200-meter detection range, the surround radar sensors support complex automated-driving scenarios such as automatic lane-changing and adaptive cruise control.

Tires: serial test winner

The Tires group sector generated sales of €3.3 billion (Q1 2023: €3.5 billion, -5.0 percent). At 11.7 percent, its adjusted EBIT margin was still in the double digits, albeit down on the first quarter of the previous year (Q1 2023: 13.4 percent). The main reasons were weak tire markets in the truck and original equipment business, negative exchange-rate effects and fewer workdays in March. This, in turn, shifted the tire-replacement business to April, which already appears to be a considerably stronger month for earnings. In the months ahead, the Tires group sector will also benefit from an expected increase in demand.

Continental continues to set standards in premium tires, with its tire technologies receiving multiple expert awards in the past quarter. The latest PremiumContact 7 summer tire was crowned test winner by various German and international trade magazines, with the editors of “auto, motor und sport,” for instance, awarding it a rating of “outstanding.” Another test winner was the SportContact 7 tire in the AutoBild sportscars test.

In addition, Continental has acquired mold-manufacturing specialist EMT Púchov s.r.o., based in Slovakia – thus completing its internal portfolio for mold-making technologies. Continental can now independently produce tire molds for all applications. EMT is an important manufacturer of special tire molds, especially for commercial vehicle and specialty tires. Molds are used in tire construction as part of the vulcanization process. In this production step, raw rubber is converted into flexible and elastic rubber, which gives the tire its desired stability and shape.

Furthermore, all newly introduced passenger-car and 4x4 tire lines for Continental’s secondary brands in Europe will now feature the EV-compatible logo on their sidewall. Continental is thus further expanding its product strategy for electric vehicles. All of the company’s new tires meet the high requirements for electric vehicles and at the same time support conventionally powered vehicles in driving efficiently and safely.

In 2023, Continental supplied tires to all 10 of the world’s highest-volume manufacturers of fully electric vehicles for the first time. In the Asia-Pacific region, it provided all of the five highest-volume manufacturers of electric vehicles with original equipment tires – another first for the company. The company was also able to defend its strong position in the Europe, Middle East and Africa (EMEA) and North, South and Central America (The Americas) regions, where the five highest-volume manufacturers continue to rely on Continental tires.

ContiTech: improvements expected as the year progresses

The ContiTech group sector posted sales of €1.6 billion (Q1 2023: €1.7 billion, -4.8 percent) and an adjusted EBIT margin of 5.4 percent (Q1 2023: 6.5 percent) in the past quarter. Earnings were adversely impacted by weak industrial demand. In addition, the Original Equipment Solutions (OESL) business area, which makes up a large part of ContiTech’s business with automotive manufacturers, is not expected to see improvements until the second half of the year.

A particularly sustainable innovation from Continental is its solution for combating weeds, which allows farmers to dispense with herbicides and rid their fields of weeds in a fully sustainable way. The system, based on optical sensor technology and supported by software and artificial intelligence, detects weeds with precision and destroys them using boiling water – all technologies developed in-house at Continental. The system delivers a highly efficient, precise and sustainable method for combating weeds.

Overview of all available materials: Results Q1 | 2024