Continental Outperforms Its Markets in Historically Weak Second Quarter

- Global vehicle production in the second quarter at 12.3 million units (down 45%)

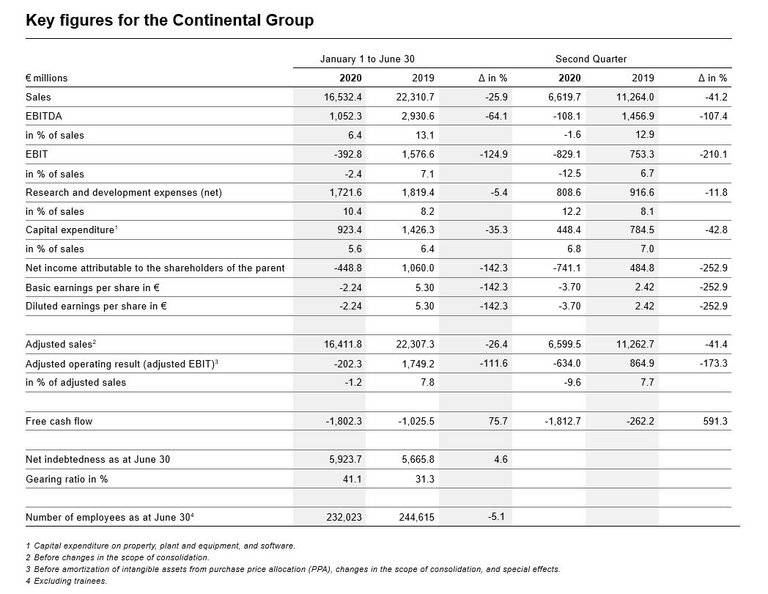

- Organic growth of -40 percent; sales of €6.6 billion (Q2 2019: €11.3 billion)

- Adjusted EBIT of ‑€634 million (Q2 2019: €865 million); adjusted EBIT margin of ‑9.6 percent (Q2 2019: 7.7 percent)

- Net income of‑€741 million (Q2 2019: €485 million)

- Fixed costs reduced by more than €400 million in the second quarter

- CEO Dr. Elmar Degenhart: “At the low point of the worst economic crisis experienced by the automotive industry since the end of the Second World War, we outperformed our markets. We are keeping our targets firmly in sight. Our tough cost-cutting measures are having a quick and noticeable effect.”

- Savings goals for 2020: cut fixed cash costs by more than 5 percent; reduce capital expenditure by more than 25 percent

- Continental is currently still refraining from providing a detailed outlook for the 2020 fiscal year

Hanover, August 5, 2020. As expected, the sales and earnings of Continental were down substantially in the second quarter of 2020 due to the effects of the coronavirus pandemic. Continental nonetheless outperformed its markets. “A market crash in the automotive industry like the one we are experiencing now has not been seen since the end of the Second World War. In the first and second quarters of 2020, when the economic crisis in the automotive industry was at its worst, we outperformed the respective markets in China, the USA and Europe,” said Dr. Elmar Degenhart, Continental CEO, when presenting the half-year figures on Wednesday in Hanover.

Consolidated sales in the second quarter amounted to €6.6 billion (Q2 2019: €11.3 billion). Before changes in the scope of consolidation and exchange-rate effects, sales declined by 40 percent. At the same time, the globalproduction of passenger cars and light commercial vehicles fell by about 45 percent in the second quarter to a total of 12.3 million units (Q2 2019: 22.1 million units), according to preliminary data. As a result of temporary plant closures due to the coronavirus pandemic, second-quarter production figures in Europe and North America were very weak, at 2.0 million units (-63 percent) and 1.3 million units (‑69 percent), respectively. In contrast, production in China increased to 9 percent year-on-year thanks to government subsidy programs, with 5.9 million passenger cars and light commercial vehicles rolling off the lines.

The adjusted operating result in the second quarter was ‑€634 million (Q2 2019: €865 million), corresponding to an adjusted EBIT margin of ‑9.6 percent (Q2 2019: 7.7 percent). Net income totaled ‑€741 million (Q2 2019: €485 million).

“Continental is forward-looking and well prepared for crises, which is evident particularly in such a challenging situation. We are continuing to keep our targets firmly in sight,” Degenhart said. Continental benefits from its cross-sectoral setup with a strong foothold in the industrial and replacement tire business, in addition to its automotive original equipment business. “Over the past few years, we have consistently strengthened our business with industrial and end customers. This makes us less susceptible to the ups and downs of the automotive industry,” commented Degenhart. Continental’s business with industrial and end customers was down 23 percent in the second quarter, demonstrating that it is substantially more robust than global vehicle production, which fell by 45 percent in the same period.

Stricter cost discipline, lower capital expenditure and reduced working hours

In light of the unexpected deterioration of the economic environment, Continental lowered its fixed costs by more than €400 million in the second quarter compared with the same period of the previous year. For the year as a whole, the company is well on the way to reducing fixed cash costs by more than 5 percent compared with the previous year. “Our balance sheet remains very sound, due in part to the savings measures that we initiated immediately. Our tough cost-cutting measures are having a quick and noticeable effect. We are thus giving ourselves room to maneuver and remain on track,” said Degenhart.

In the second quarter of 2020, Continental reduced its capital expenditure on property, plant and equipment, and software to €448 million (Q2 2019: €785 million). All business areas contributed to the decrease. As a result, the capital expenditure ratio was down to 6.8 percent after 7.0 percent in the comparative period of the previous year, despite the substantial decrease in sales. For the year as a whole, the company is planning to reduce its investments by more than a quarter compared to the previous year. At the end of the first quarter, Continental had estimated its savings potential for investments at more than 20 percent.

Capital expenditure on research and development in the second quarter amounted to €809 million (Q2 2019: €917 million). As a result of the substantial decrease in sales, the ratio rose to 12.2 percent after 8.1 percent in the same period of the previous year.

Since early June, all Continental plants worldwide have resumed production. Public life in some regions is still restricted by the coronavirus pandemic, however, and some plants’ capacities are being used at greatly reduced levels in line with the substantially lower global demand. Depending on how the pandemic and its consequences continue to develop, it is possible that the company will once again have to make temporary adjustments to production at certain plants. At present, about 25 percent of all employees are working reduced hours worldwide. In Germany, around 30,000 employees worked an average of five days less in June.

Still no detailed forecast due to economic uncertainty

As announced at its Annual Shareholders’ Meeting in mid-July, Continental anticipates a challenging market environment in the third quarter of 2020. Rising production figures for cars do indicate higher sales than in the second quarter of 2020, but they will most likely be much lower than in the third quarter of 2019. Economic uncertainty remains high. Though the business development of the Continental Group improved over the course of the second quarter, the economic environment continues to be characterized by considerable uncertainty due to the ongoing coronavirus pandemic. It therefore remains difficult to gauge possible further adverse consequences on production, supply chains and demand. Continental is currently still refraining from providing detailed forecasts for 2020 as a whole. However, the DAX company is expecting sales volumes, sales and adjusted EBIT to fall significantly short of the previous year’s figures. The decline in earnings is also expected to lead to a considerable decrease in free cash flow in 2020 compared to the previous year.

For the third quarter of 2020, Continental expects global vehicle production to fall substantially by ‑10 to ‑20 percent year-on-year. Market observers currently estimate that fewer than 70 million vehicles will be produced in 2020, which would correspond to a year-on-year decrease of more than 20 percent (2019: 89 million vehicles).

Cash and cash equivalents at a very high level; capital expenditure reduced substantially

In the second quarter of 2020, free cash flow before acquisitions and carve-out effects amounted to -€1.8 billion (Q2 2019: -€29 million). “The negative free cash flow in the second quarter is a direct consequence of the sharp decline in business due to the coronavirus pandemic,” explained Wolfgang Schäfer, Continental CFO. The decline is primarily due to the lower EBIT figure versus the prior-year period as well as negative working-capital effects. The latter are the result of sales volatility in the final weeks of the second quarter and are expected to normalize again if the business trend stabilizes. On the second-quarter reporting date, Continental had cash and cash equivalents of €10.1 billion (March 2020: €6.8 billion). In May and June, Continental placed three bonds with a total volume of more than €2.1 billion and also expanded its credit facility with its core banks by €3 billion.

Continental accelerates AI development using supercomputer

“Vehicle production is currently on the decline, but the transformation of the automotive industry continues unabated. On the one hand, we have to cut costs rigorously, but on the other, we must continue to invest in the development of new technologies,” Degenhart pointed out. In the advanced driver assistance systems business, for example, Continental is continually expanding its long-standing position as market leader.

Last week, the technology company announced that since early 2020, it has been advancing the development of future technologies with a supercomputer that is unrivaled in the automotive industry. From this new computer cluster, the developers at Continental’s locations around the world get the computing power and storage that they need for highly complex and data-intensive developments – including, in particular, those relating to artificial intelligence. This is required for the development of pioneering future technologies in assisted, automated and autonomous driving, for example. The new supercomputer from Continental is ranked according to the current list of TOP500 supercomputers as the top system in the automotive industry. Continental is thus accelerating its development, which leads in terms of technology, while also underlining its core competencies in software and networking as well as in the architecture of systems.

“Software is the oxygen of the industry, and we expect it to generate enormous profitable growth in the future. The reason is that there will be more and more functions in the vehicle,” Degenhart stated with confidence. He pointed out that value creation with computer programs will increase accordingly, growing by double-digit percentages each year. “Here, we are in a great position as a software powerhouse with more than 20,000 software and IT experts,” he added.

For example, with the development of high-performance computers – the digital heart of modern vehicles – Continental has already secured lifetime sales exceeding €3 billion. A single customer alone will probably have received more than 2.5 million of such compact high-performance computers by 2022. This puts Continental among the front-running companies in this area of the industry. A particularly high-performance vehicle server was recently developed for Volkswagen. This In-Car Application Server (ICAS1) enables a high degree of vehicle connectivity for the new electric vehicles in VW’s ID. model series – such as the ability to quickly and securely install safety updates via a wireless connection. By 2022, Continental expects more than ten further projects.

Coronavirus bridge: innovative ways to safeguard productivity and employment

“The transformation of the automotive industry and overcoming the coronavirus pandemic are huge challenges for all of us. They will lead to far-reaching changes, also at Continental. We are shaping these changes together with the workforce, searching for balanced and fair solutions that are in line with our values, strengthen our innovative prowess and maintain our viability as a company,” explained Dr. Ariane Reinhart, Continental Executive Board member for Human Relations. “We understand the uncertainty felt by our employees and that some are concerned about their jobs. But we are going to make the most of our opportunities for the future, particularly in this crisis. In order to do this, we need a combination of comprehensive agreements with employee representatives as well as specific solutions for each of our locations that are affected,” she added. It is all about building a “coronavirus bridge,” with innovative approaches to help close a cost gap of several hundred million euros while at the same time safeguarding employment and productivity. “The reduction in working hours is a reasonable approach to safeguard production while gaining employment prospects and expanding upon them with training. The additional time should be used for training and education, which increases each individual’s employability,” she added.

Business outside of the automotive industry develops better in the second quarter

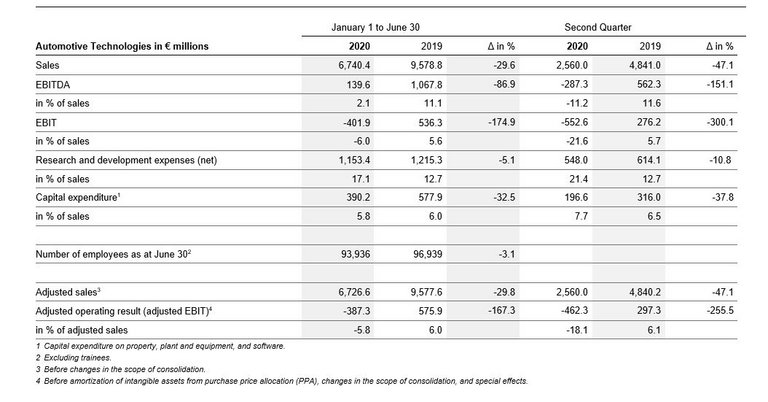

Sales in the Automotive Technologies group sector amounted to €2.6 billion (Q2 2019: €4.8 billion), and the adjusted EBIT margin was ‑18.1 percent (Q2 2019: 6.1 percent). Organic sales growth came to ‑45.6 percent.

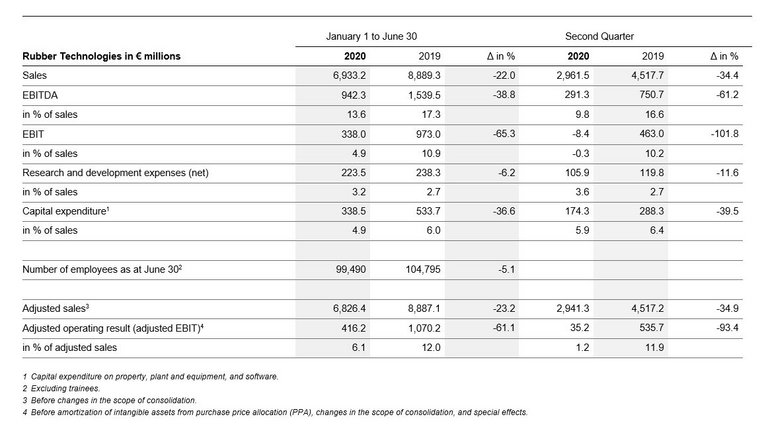

The Rubber Technologies group sector achieved sales of €3.0 billion (Q2 2019: €4.5 billion) and an adjusted EBIT margin of 1.2 percent (Q2 2019: 11.9 percent). Organic sales growth came to ‑33.1 percent.

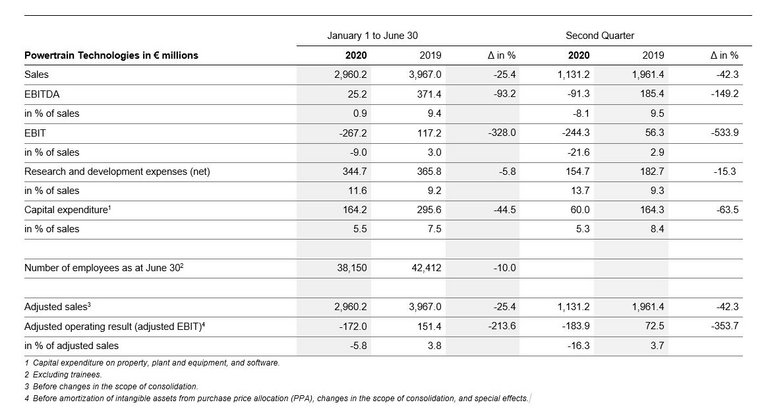

In the Powertrain Technologies group sector, sales amounted to €1.1 billion (Q2 2019: €2.0 billion) and the adjusted EBIT margin was -16.3 percent (Q2 2019: 3.7 percent). Organic sales growth came to -40.8 percent.

Please finde here an overview of all available materials relating to the publication results first half 2020.

Dr. Elmar Degenhart

Dr. Elmar Degenhart, Chairman of the Executive Board Continental AG

Wolfgang Schäfer

Member of the Executive Board, Finance, Controlling, Compliance, Law, and IT, CFO