Continental Study: Increasing Satisfaction with Software in Road Transport, but Many Companies Not Using It

- Unexploited potential: More than a third of the companies surveyed, mostly smaller companies, are not using software solutions

- Most logistics providers would like more driver assistance functions and fuel-saving technologies

- Companies want investments in technology to pay off in a short time

- Software security is considered important, but there is little willingness to invest

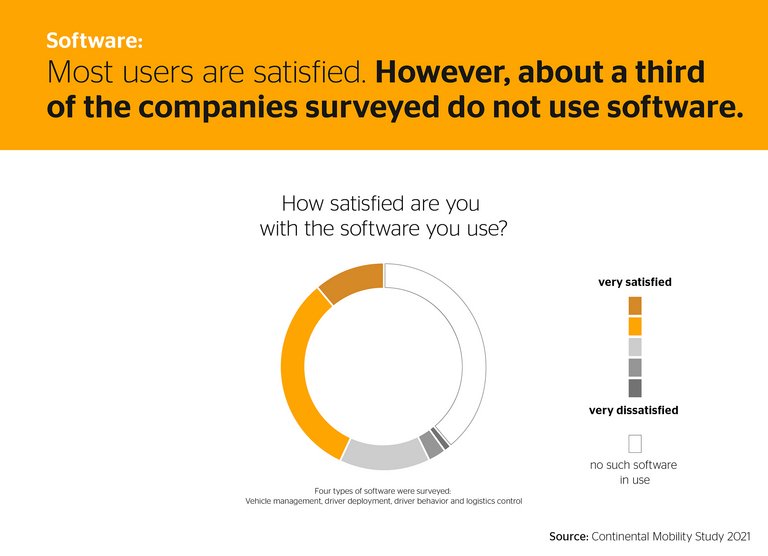

Schwalbach, Germany, August 16, 2021. Satisfaction in the transport industry with the software used for managing drivers, vehicles and logistics operations is growing, but more than a third of the companies surveyed are not using these solutions. This is a key finding of the study “The Connected Truck”, which was carried out for the second time since 2016 by the renowned social research institute infas on behalf of the technology company Continental. The percentage of non-users – most of them small companies – is roughly the same as in the previous survey. In a reflection of current developments in this sector, it was also shown that when it comes to equipment, logistics providers are mainly interested in driver-assistance functions and fuel-saving technologies. Vehicle tracking and software security are also considered important, but companies are careful to invest. A summary of the survey results can be found here.

Software: The industry needs tailor-made solutions – including for small businesses

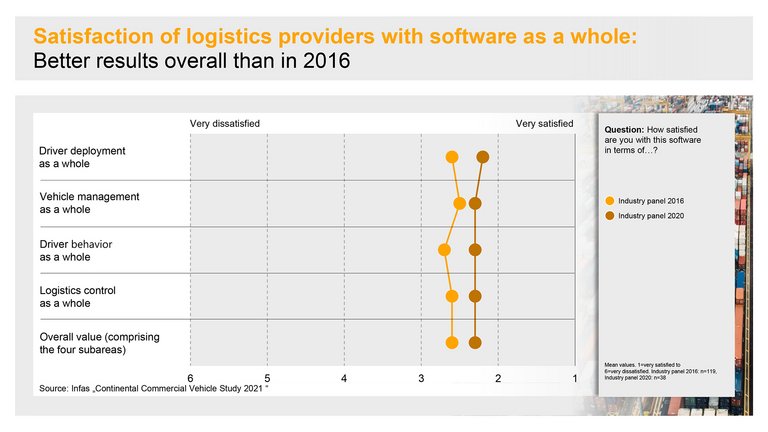

A direct comparison with the previous study (2016) reveals a clear trend. Logistics and transport companies that use software solutions are now more satisfied with them on the whole. In particular, the companies surveyed rate software for monitoring driver behavior roughly half a point better on a scale from 1 to 6 than in 2016. In day-to-day work, this software is also the most important kind, followed by software for planning driver deployment, vehicle management and logistics operations.

On the other hand, although a majority of the companies surveyed use such software, many others use it rarely or not at all. More than a third – especially smaller companies – are non-users.

“Logistics companies that operate small fleets are just as much affected by rising costs and pressure to increase efficiency as large transport companies,” says Gilles Mabire, who heads Continental’s Commercial Vehicles and Services Business Unit. “But small companies are not yet convinced that software can significantly benefit them. The industry must address this issue and provide solutions that are tailor-made for these customers. It must also point out the advantages of existing solutions for smaller companies. If these big differences in use continue to prevail, the gap might grow between large, profitable companies that make extensive use of technology on the one hand and smaller ones with shrinking profits on the other.”

Technology requirements: demand for driver-assistance systems and fuel-saving solutions

As in the previous study (2016), about two thirds of the companies surveyed expressed a wish for more driver-assistance functions, and more than half would welcome further fuel-saving technologies. In decreasing order of importance, they showed an interest in more comfort functions in the interior, tire pressure monitoring systems and systems for better communication with drivers. “These needs are in keeping with current changes in the transport sector,” says Mabire. “New regulations have been introduced to improve road safety and reduce vehicle emissions. An example is the EU directive to reduce CO2 emissions. As a consequence, the demand for these technologies will remain high, and it can be expected to increase.” In addition, cost pressure continues to be a major factor in the industry, so companies must save money where they can. “Fuel accounts for a large portion of the costs in a fleet, and this is where logistics providers can achieve the biggest savings.”

Investments must pay off quickly

The pressure to cut costs and increase efficiency also plays an important role when it comes to willingness to invest. Logistics providers need their investments to pay off quickly. More than three quarters of the companies surveyed stated that investments in fuel-saving driving have to pay for themselves within two years – and for companies with small numbers of vehicles this period is even shorter. “Their requirements are challenging, which means that significant benefits are expected from new technologies,” says Mabire. “Manufacturers and suppliers must therefore develop solutions that yield economic benefits within a short time.”

High security requirements for software, but little willingness to invest

The survey participants also emphasized their need for software that fulfills high security standards. “Increasing data traffic has opened up greater potential areas of attack for cybercriminals,” says Mabire. “The industry must offer solutions that are suitably sophisticated and practice-proven. But security costs money; it can’t be provided for free.” Only about half of the companies surveyed had already taken defensive measures for an attack on logistics or fleet management systems. Three quarters said they were not planning any major investments within the next six to twelve months. “Real willingness to invest is not keeping up with statements about the importance of this topic. One reason might be that no transport company has yet been the victim of a cyberattack. But the growing number of attempted attacks is a sign that the problem is becoming increasingly important.”

About the study:

Between February and May 2020, on behalf of Continental, the infas Institute for Applied Social Science surveyed the first and second management levels of small, medium-sized and large companies in the German logistics and transport industry, including trucking companies and logistics & transport companies. The scope of the study was reduced due to the Covid-19 crisis. A total of 45 companies took part in the survey, the results of which can be taken as an indication of trends.

Christopher Schrecke

Media Spokesperson Safety and Motion

Continental Automotive