Focus on Value Creation: Continental Presents Strategy to Achieve Mid-term Targets

Capital Market Day 2023

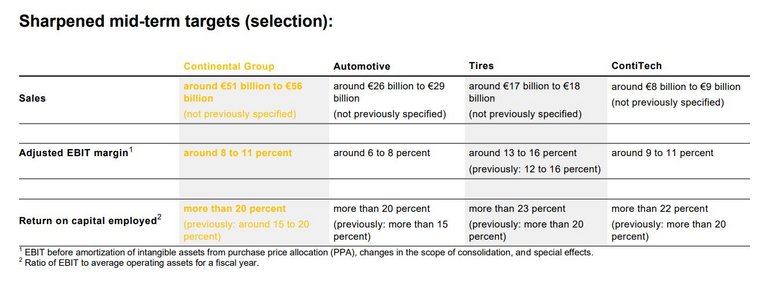

- Sharpened mid-term targets: sales of around €51 billion to €56 billion; adjusted EBIT margin of around 8 to 11 percent

- Increased corridor for dividend distributions: around 20 to 40 percent of net income (previously: around 15 to 30 percent)

- CEO Nikolai Setzer: “Our strategy aims to increase our value creation. This will allow us to continue to develop into the mobility and material technology group for safe, smart and sustainable solutions”

- Opening up of new strategic options: User Experience business area to become organizationally independent

- Review of measures for further business activities within Automotive

- Tires: premium tires will continue to create opportunities for profitable growth

- ContiTech to strengthen strategic focus on industrial business

Hanover, December 4, 2023. At today’s Capital Market Day in Hanover, Continental announced its strategy for increasing value creation. To achieve its mid-term targets, the company will adopt a package of cost-reduction measures. It thus aims to achieve a consolidated adjusted EBIT margin of around 8 to 11 percent in the next two to three years and then improve within this range. The company has also sharpened its sales expectations. In the short term (two to three years), Continental aims to achieve total sales of around €44 billion to €48 billion. In the medium term (three to five years), it expects total sales to be around €51 billion to €56 billion (outlook for 2023: around €41 billion to €43 billion). It will also carve out parts of the business and carry out further portfolio reviews. Furthermore, the DAX-listed company is increasing the corridor for dividend distributions to around 20 to 40 percent of net income (previously: around 15 to 30 percent).

In the Automotive group sector, Continental will step up its focus on value-creating business areas with high growth. In doing so, the group sector will prepare for the User Experience business area to become organizationally independent. This step will open up new strategic options for the displays and HMI controls business. The technology company is also reviewing measures for further business activities within Automotive that are expected to contribute around €1.4 billion to consolidated sales this fiscal year.

In the Tires group sector, Continental will continue to rely on stable earnings and operational excellence. Sustainability, electric mobility and digital tire services will also create various opportunities for further profitable growth. In its ContiTech group sector, Continental will focus on reliable profitability thanks to material solutions made from rubber and plastics. At the same time, the company will strengthen its strategic focus on the group sector’s industrial business with the aim of increasing its share of ContiTech’s sales from currently around 55 percent to 80 percent.

“Our strategy aims to increase our value creation. This will allow us to continue to develop into the mobility and material technology group for safe, smart and sustainable solutions,” said Continental CEO Nikolai Setzer on Monday in Hanover, adding: “There are good reasons to invest in Continental. We have a clear strategy to achieve our mid-term targets. We will invest specifically in those areas with value creation upside and expand our technology position wherever this gives us an edge over the competition. Our three group sectors make up a balanced and resilient portfolio, which we and our highly effective and efficient team will manage flexibly, proactively and with foresight.”

Referring to the company’s development over the past few years, Setzer added: “After a long period of success, we have more recently had to face many challenges, and our results have not always met our expectations. At the same time, however, this extremely challenging time has also made us more robust. We are therefore entering this next phase of increased value creation in a strong position.”

At the Capital Market Day, Continental CFO Katja Garcia Vila confirmed the current outlook for fiscal 2023 and emphasized: “Achieving our mid-term targets is a priority. To do so, we have a clear plan that we will implement rigorously. With our planned measures, we will reach the corridor for our expected mid-term adjusted EBIT margin in the next two to three years and then continue to improve within this range.” Garcia Vila added: “Our vision is to create value for a better tomorrow. The foundation for this is a strong balance sheet and strong free cash flow. We are keeping both firmly in sight. And all of our stakeholders will benefit. We are underlining the importance of our shareholders with our updated dividend policy.”

Automotive: focus on value-creating business areas with high growth

With the strategy announced today, the Automotive group sector aims to increase its long-term profitability and competitiveness. To this end, the strategy focuses on achieving a leading market position in all business areas, improving processes and structures, reducing costs and concentrating on value-creating business areas with high growth. The company has already decided on a number of measures, including making the User Experience business area organizationally independent, which will open up new strategic options for this business. With expected sales of around €3.5 billion by the end of the year and an order volume of more than €7 billion (production launch after 2022), User Experience is among the market leaders in display solutions, head-up displays and digital instrument clusters. The technology company is also reviewing measures for further business activities within Automotive that are expected to contribute around €1.4 billion to consolidated sales this fiscal year.

Independently of this, Automotive is aiming to reduce costs significantly by €400 million per year from 2025. Administrative structures, interfaces, hierarchy levels and complexity will be reduced, for example, and decision-making structures and processes simplified. Automotive is also planning to lower its share of research and development expenses. The group sector is therefore aiming to reduce net research and development expenses in the short term to around 11 percent of sales (expected in 2023: around 12 percent). In the medium term, the share is expected to be less than 10 percent. This will be achieved by consolidating its 82 development locations worldwide, for example.

Premium tires will continue to create opportunities for profitable growth

The Tires group sector stands for profitable growth and exceptional value creation. Over the past five years, Tires has increased its sales by an average of 4.3 percent annually. The basis for the group sector’s commercial success is its operational efficiency. Capacity and state-of-the-art production technologies are continually adapted to changing market requirements. This enables Tires to benefit from major economies of scale and scope, with more than 80 percent of its global production capacity bundled in so-called megafactories.

The megatrends of sustainability, electric mobility and digitalization offer a wide range of opportunities for further profitable growth. Continental already offers the most sustainable production tire on the market and is growing strongly in the area of data-based tire services. In total, it has more than 500 original equipment approvals for supplying fully electric models from automotive manufacturers worldwide, including all 10 of the world’s highest-volume manufacturers of fully electric cars.

Based on this strong market position, the Tires group sector is aiming for sales of around €17 billion to €18 billion and an adjusted EBIT margin of around 13 to 16 percent in the medium term. The recovery of the current weak demand, particularly in the European tire-replacement business, continuous increases in efficiency, the ongoing trend toward larger and higher-performing tires as well as high cost discipline will form the basis for the expected sales and margin increases. The Tires group sector sees strong growth potential particularly in the Asia-Pacific and North and South America regions.

ContiTech to strengthen strategic focus on industrial business

ContiTech will continue to focus on its industrial business. The group sector therefore plans to increase the share of sales accounted for by the industrial business from currently around 55 percent to 60 percent in the medium term and to improve its adjusted EBIT margin to around 9 to 11 percent. ContiTech’s ambition is to achieve an industrial share of sales of around 80 percent.

ContiTech’s industrial growth areas are primarily in energy, agriculture and construction as well as interior design. These industrial fields place high demands on materials and products, for which ContiTech is well positioned thanks to its high level of materials expertise, including for hoses, belts, conveyor belts and surfaces, as well as its uniquely diversified product portfolio.

As already announced, the Original Equipment Solutions (OESL) business area – comprising the automotive business of ContiTech except for surface materials – will also become organizationally independent. OESL is expected to become fully independent in 2025. All strategic options will be reviewed as part of this process, including the entry of a strategic investor, a joint venture or a sale.