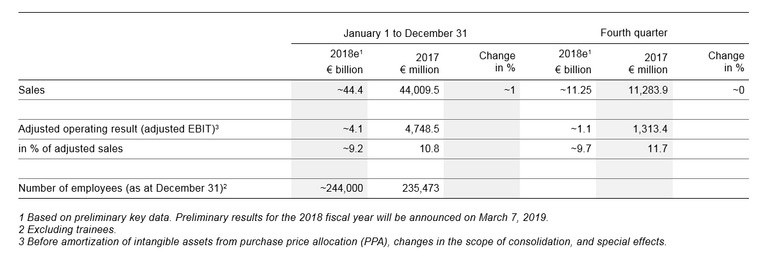

Continental Achieves Annual Targets

- Stable operating performance in fourth quarter as expected

- Annual sales rise to around €44.4 billion (organic growth at about 3 percent)

- Adjusted EBIT for the year: around €4.1 billion (margin at about 9.2 percent)

- Free cash flow was higher than expected at about €1.8 billion

- 2019 outlook: Consolidated sales of about €45 to €47 billion at constant exchange rates, adjusted EBIT margin of about 8 to 9 percent

- Powertrain division successfully transformed into an independent group of legal entities

Hanover (Germany), Detroit (U.S.A.), New York (U.S.A.), January 14, 2019. Continental has achieved its targets for the previous fiscal year. Despite declining automotive markets, the technology company continued to grow profitably. The DAX-listed company announced that its operating performance was as expected in the fourth quarter. The final quarter was bolstered in part by strong sales of winter tires and the positive market development in the non-automotive industrial business.

Furthermore, the DAX-listed company also transformed its Powertrain division into an independent group of legal entities on schedule at the start of 2019, as announced. A possible partial IPO by the middle of the year is now being prepared.

“We achieved a respectable result and achieved our adjusted annual targets. We are continuing to grow profitably. As feared, the decline of the automotive markets intensified significantly once again in the fourth quarter. This, combined with the profound changes in our industries, is reducing our growth rate,” said Continental CEO, Dr. Elmar Degenhart, explaining the preliminary results for the year. “Against this backdrop, the strong performance of our around 244,000 employees at Continental worldwide is all the more remarkable. On behalf of the entire Executive Board, I would like to express my thanks for the outstanding commitment of our global team in 2018.”

In its automotive, tire and industrial business areas, the international technology manufacturer is forecasting global consolidated sales of about €45 to €47 billion at constant exchange rates and an adjusted EBIT margin of about 8 to 9 percent for the current fiscal year. Continental’s outlook is based in part on the assumption that the global production volume of cars and light commercial vehicles in 2019 will be about the same as that of the previous year.

Continental will release its preliminary 2018 business figures on March 7, 2019, as part of its annual financial press conference to be broadcast online.

Continental’s growth again higher than market in the fourth quarter

According to preliminary key figures, the reported sales growth for 2018 as a whole amounted to about 1 percent year-on-year (organic growth: about 3 percent). Consolidated sales thus increased to around €44.4 billion. The adjusted EBIT margin came to about 9.2 percent, which is equivalent to adjusted operating earnings of around €4.1 billion. In the fourth quarter, Continental generated sales of around €11.25 billion, which is the same level as the same quarter of the previous year. Adjusted EBIT amounted to around €1.1 billion in the final quarter of 2018 and the adjusted EBIT margin came to about 9.7 percent. At around €1.8 billion, free cash flow adjusted for acquisitions and funding of U.S. pension obligations exceeded expectations.

Adjusted for changes in the scope of consolidation and exchange rates, Continental’s sales growth was about 3 percent in the past fiscal year. This positive development was countered by further declines in the global production of passenger cars and light commercial vehicles, which materialized as feared and amounted to -1 percent in 2018, based on preliminary data. In the fourth quarter of 2018, global production decreased as well, down 4 percent year-on-year.

Cautious market outlook

Continental believes the declining market development is likely to continue unchanged in the first half of 2019. “The main reasons for this are the continued weak demand in China, the trade dispute between the U.S.A. and China, and further decreases in call-offs as a result of the switch to WLTP in Europe. There is also the general uncertainty around Brexit,” said Continental CFO Wolfgang Schäfer, explaining the market outlook. In the second half of the year, the company expects slight market growth in comparison with the low baseline of the previous year: “For fiscal 2019, we expect the production volume of cars and light commercial vehicle to be on a par with the previous year,” said Schäfer.

Future annual forecasts in terms of ranges

“We have decided to express the expectations we have for our business development in ranges, as is usual in our industry,” said Schäfer. The reason for this is that it is becoming much more difficult to predict the development of the ever-more volatile market environment with pinpoint accuracy. “In phases of such profound technological transformation in the automotive industry as at present and an increasingly ambiguous unstable economic environment, precise forecasts suggest an accuracy that is simply no longer possible,” Schäfer added.

For the current fiscal year, Continental is expecting sales of about €45 to €47 billion with constant exchange rates and an adjusted EBIT margin of about 8 to 9 percent across the entire corporation.

Powertrain successfully transformed into an independent group of legal entities

On January 1, 2019, as announced, Continental completed the transformation of its Powertrain division into an independent group of legal entities on schedule. The new legal entity, whose new name is to be announced soon, is to be prepared for a possible partial IPO by the middle of the year. This move is part of one of the largest organizational changes in the technology company’s history.

“After this initial key milestone in our realignment, we are now working at full steam to prepare for the partial IPO of our successful powertrain business, which could be possible from mid-2019,” said Degenhart, expressing his satisfaction.

The realignment provides for the creation of a holding structure of Continental AG under the new “Continental Group” umbrella brand. It will be supported by three group sectors, namely “Continental Rubber,” “Continental Automotive” and “Powertrain” The reporting structure and the new names are to be used starting 2020.

“Our realignment is a response to the profound changes in the automotive industry and the associated challenges,” said Degenhart. Continental is enjoying great growth potential thanks to new technologies, larger customer orders and new opportunities in software solutions and services. “We are realigning our organization to technological challenges and changing market requirements at an early stage. We are focusing our expertise and thus programming Continental for a successful future,” he added.

Dr. Elmar Degenhart

Dr. Elmar Degenhart, Chairman of the Executive Board Continental AG

Wolfgang Schäfer

Member of the Executive Board, Finance, Controlling, Compliance, Law, and IT, CFO