Continental Posts Strong Earnings in Tires and High Order Intake in Automotive

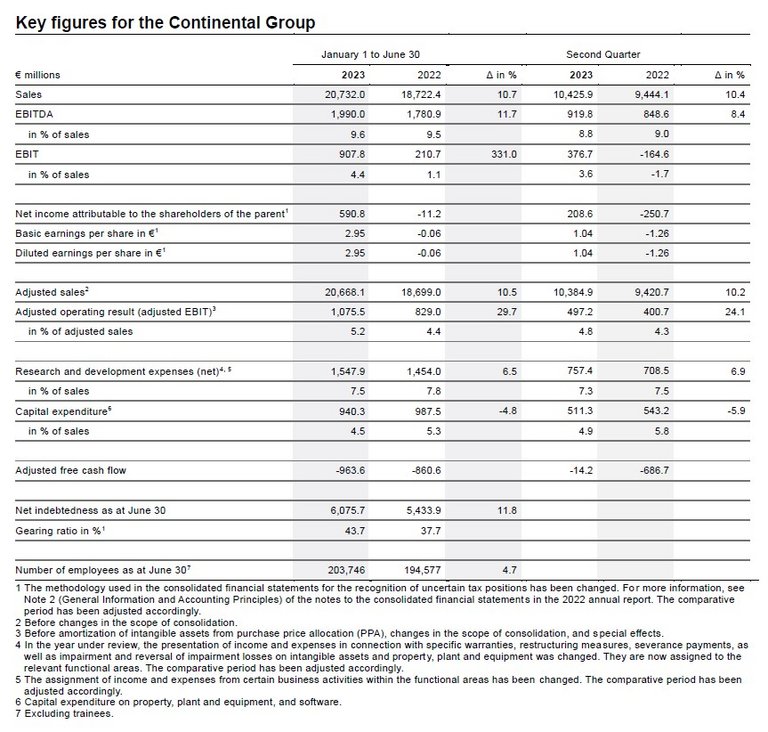

- Consolidated sales of €10.4 billion (Q2 2022: €9.4 billion, +10.4 percent)

- Adjusted EBIT of €497 million (Q2 2022: €401 million, +24.1 percent)

- Adjusted EBIT margin of 4.8 percent (Q2 2022: 4.3 percent)

- EBIT of €377 million (Q2 2022: -€165 million)

- Net income of €209 million (Q2 2022: -€251 million)

- Adjusted free cash flow of -€14 million (Q2 2022: -€687 million)

- CEO Nikolai Setzer: “Despite difficult market conditions, our Tires group sector ended the second quarter with good earnings once again”

- CFO Katja Dürrfeld: “We stabilized our adjusted free cash flow year-on-year as well as compared with the first quarter of 2023”

- High order intake in Automotive of €8.6 billion in the second quarter

- Adjusted outlook: sales in the Tires group sector of around €14.0 billion to €15.0 billion (previously: €14.5 billion to €15.5 billion); consolidated sales of around €41.5 billion to €44.5 billion (previously: €42 billion to €45 billion)

Hanover, August 9, 2023. Continental ended the second quarter of 2023 with strong earnings again in the Tires group sector and high order intake in Automotive of around €8.6 billion. The ContiTech group sector achieved solid results, while earnings in Automotive fell short of expectations, mainly due to currency effects and continuing costs for special freight. Furthermore, inflation-related price negotiations scheduled for the second quarter are still ongoing. As a result of updated market expectations in the tire-replacement business, Continental has adjusted its outlook for sales in the Tires group sector and for consolidated sales. The outlook for the adjusted EBIT margins remains unchanged. The technology company therefore expects consolidated earnings to increase in the second half of the year.

“Despite difficult market conditions, our Tires group sector ended the second quarter with good earnings once again. ContiTech’s performance remained solid. Earnings in Automotive, however, fell short of expectations. Here we will need to make up considerable ground in the second half of the year. By doing so, we will also improve our consolidated margin,” said Continental CEO Nikolai Setzer in Hanover on Wednesday. “Through our partnership with Aurora, we have generated significant order intake and taken a major technological step forward in autonomous mobility. Together, we will bring the first commercially scalable autonomous trucking system to the US market.”

In the second quarter of 2023, Continental achieved consolidated sales of €10.4 billion (Q2 2022: €9.4 billion, +10.4 percent). Its adjusted operating result (adjusted EBIT) was €497 million (Q2 2022: €401 million, +24.1 percent), corresponding to an adjusted EBIT margin of 4.8 percent (Q2 2022: 4.3 percent).

Net income in the second quarter amounted to €209 million (Q2 2022: -€251 million). Adjusted free cash flow was -€14 million (Q2 2022: -€687 million).

“We stabilized our adjusted free cash flow year-on-year as well as compared with the first quarter of 2023. As announced, we made initial progress with our inventories, which we will need to reduce further. The same applies to our receivables, which remain high and are also having a negative effect on our free cash flow,” said Continental CFO Katja Dürrfeld.

Adjustment of market outlook and forecast for fiscal 2023

For the current fiscal year, Continental expects the production of passenger cars and light commercial vehicles to increase by 3 to 5 percent year-on-year (previously: 2 to 4 percent). For the global tire-replacement business, the technology company expects sales volumes to develop by -2 to 0 percent (previously: 1 to 3 percent).

Continental has adjusted its outlook for the current fiscal year due to the declining European and North American markets in the tire-replacement business. Continental now expects sales in the Tires group sector of around €14.0 billion to €15.0 billion (previously: €14.5 billion to €15.5 billion) and consolidated sales of around €41.5 billion to €44.5 billion (previously: €42 billion to €45 billion). The outlook for the company’s other sales and margin expectations remains unchanged.

Continental also continues to expect significantly higher costs for materials, wages and salaries as well as energy and logistics in fiscal 2023. These are expected to impact earnings by around €1.4 billion (previously: €1.7 billion).

Automotive production higher year-on-year

According to preliminary figures, the global production of passenger cars and light commercial vehicles amounted to almost 22 million units in the second quarter of 2023, representing an increase of around 16 percent compared with the relatively weak prior-year quarter (Q2 2022: 19.0 million units).

Vehicle production in Europe grew to around 4.4 million units in the months of April, May and June 2023 (+15 percent). North America also recorded an increase of around 15 percent to around 4.1 million units. China recorded a substantial year-on-year rise of 20 percent to around 6.6 million units.

Automotive improves sales and earnings year-on-year

In the Automotive group sector, sales increased by 19.0 percent to €5.1 billion (Q2 2022: €4.3 billion). With its sales growing organically by 20.1 percent before exchange-rate effects and changes in the scope of consolidation, and global automotive production rising by around 16 percent, the group sector again outperformed the market. The adjusted EBIT margin improved from -2.5 percent in the second quarter of 2022 to -0.6 percent. Compared with the first three months of 2023, earnings were burdened by substantial negative effects from currency translation and continuing costs for special freight.

Owing to the expected additional inflation-related costs of around €1 billion in 2023 in Automotive alone, price agreements still need to be negotiated in partnership with customers. Further negotiations were successfully concluded in July of this year.

Continental also achieved high order intake in the Automotive group sector of around €8.6 billion in the second quarter of 2023. The order from the exclusive partnership with Aurora, which the Autonomous Mobility business area announced in April, made a strong contribution. Together, Continental and Aurora will bring autonomous trucking systems to the mass market – starting with the USA in 2027. This business alone will generate order intake of around €4.8 billion for Continental.

Tires group sector posts strong first half of the year

The Tires group sector had another strong quarter. Despite declining volumes in the tire-replacement business, it increased its sales to €3.5 billion (Q2 2022: €3.4 billion, +2.3 percent). Its adjusted EBIT margin was 13.7 percent (Q2 2022: 13.8 percent). This was attributable to the stable price situation and the group sector’s continued high share of premium tires.

Continental also became the first manufacturer to launch a production tire with a high share of sustainable materials – the UltraContact NXT. Comprising up to 65 percent renewable, recycled and mass balance certified materials, it combines a high share of sustainable materials with maximum safety and performance. It also has the highest possible rating (“A”) of the EU tire label in terms of rolling resistance, wet braking and exterior noise. The UltraContact NXT has been available to tire dealers in Europe since July 2023.

ContiTech strengthens its industrial business

The ContiTech group sector delivered solid second-quarter results, posting sales of €1.7 billion (Q2 2022: €1.6 billion, +8.0 percent) and an adjusted EBIT margin of 6.4 percent (Q2 2022: 4.9 percent). ContiTech thus improved its sales and earnings year-on-year, thanks in particular to inflation-related price adjustments and positive developments in a number of industrial areas. The industrial and replacement business developed positively, particularly in the area of conveyor belts and air spring systems as well as industrial hoses.

In keeping with its strategic realignment, ContiTech also strengthened its industrial business in the second quarter, with Continental fully acquiring the printing technology business of Trelleborg, headquartered in Lodi Vecchio, Italy. This strategic step expands the technology company’s range of surface solutions in the field of printing technology at the same time as boosting its business with industrial clients. As a result of the acquisition, Continental will gain around 600 employees at eight locations – in Italy (Lodi Vecchio and Dresano), France, Slovenia, the USA, Brazil, Japan and China – who mainly produce printing blankets for offset and digital printing.

The strategic realignment of ContiTech launched in May 2023 aims to enhance the group sector’s impact and efficiency, improve customer and market proximity and further expand its industrial business.

Overview of all available materials: Results H1 | 2023