The Continental Share: Life Cycles of a Security in the Changing Capital Market Development

Continental’s share price is like a seismograph for the company’s development over the past 150 years. Its fate is even more closely intertwined with the company than the price of rubber (see Chapter 4). In its long life, the Continental share has experienced spectacular highs, but also massive crashes. It survived two world wars and hyperinflations, as well as at least five major stock market collapses. In doing so, it went through the various stages of the financial and capital markets – from the often still local stock market world of the industrialization phase in Imperial Germany, to the global financial market capitalism of our present. Over many decades, Continental shares have brought prosperity to countless large and small shareholders as shareholders in Group profits. But it has also demanded a lot of perseverance from them.

The early years of the Continental share against the backdrop of economic and political upheavals

After the founding of Continental in 1871, the share was initially reserved exclusively for the founders. It was not until 1897 that it became freely traded. And yet: Until the 20th century, share ownership remained mainly in the hands of the founders. Firstly, this was due to the high price of the share: it was about twice the average annual wage of a factory worker at the time. In addition, the founders of the company at that time continued to claim privileges in the issue of shares.

As a result of the low share distribution, the price fluctuated sharply, even with low demand or sales. It was only after the turn of the century that Continental’s small and exclusive circle of shareholders expanded with new shareholders who were added from outside.

The development of Continental’s share value makes it clear how dependent its prices were on external economic and political events at home and abroad.

At the end of the 19th century, the booming bicycle tire business and the beginning of automotive tire production in particular caused the security to soar rapidly.

On the other hand, in the inflationary period after the First World War there was severe price turbulence. As a result of inflation, share prices climbed to dizzying heights: at the beginning of December 1923, the price of Continental shares reached an all-time high of 6 trillion marks.

The rapid devaluation of money in Germany carried the risk that foreign companies would take over German companies at low prices. At Continental, the company had taken precautions against a takeover at an early stage by bringing Goodrich on board, a friendly American tire company, as anchor shareholder. It gradually took over about 25 percent of the share capital and provided stable investment capital in US dollars.

For its part, the Continental Executive Board used this investment, among other things, to buy up shares in its most important competitor, Excelsior, with the clear aim of later acquiring it. This formed the basis for the rapid recovery of Continental shares in the Weimar Republic. It soon took off to reach new heights.

By 1923, Continental held three-quarters of Excelsior’s share capital. However, the takeover attempt failed, partly due to resistance on the part of the works council and the Excelsior workforce. In 1927, Continental launched a new attempt to integrate its competitor into its own group. After losing 1 million Reichsmarks in the previous year, Excelsior was financially distressed. When, in the course of the necessary restructuring, another capital increase with a new issue of shares took place, Continental secured more than 98 percent of the share capital. One of the major hurdles to the merger, that of compensating Excelsior shareholders, was therefore removed.

The Nazi era shaped the development of Continental shares through an anti-shareholder policy of the Nazi regime, with restrictions on stock exchange trading, dividend tax regulations and stop prices. Continental had been targeted by Nazi Party officials because of its dividend payments, which had increased to 14 percent. They railed against the “enrichment of shareholders to the detriment of the community.” In this context, a public debate had flared up in 1938 about the proportion of “non-Aryans” among Continental shareholders, and their “Jewish character.”

Between “economic miracle years” and a long period of crisis

After the currency reform in June 1948, Continental shares initially suffered a brief fall, as they did in 1924 and as did all other industrial company shares. However, this was followed by a long and steady upward trend.

The steep upward movement initially continued in the 1960s: During this time, Continental shares developed into a kind of people’s share, with broad diversification and many small shareholders. During this period, Continental shares were also on the recommendation lists of banks. At the beginning of February 1952, for example, the Bayerische Hypotheken- und Wechselbank had recommended 'Continental-Gummi’ as a buy, citing the gross profit generated since 1951 and the resumption of high dividend payments.

In a short time, the number of shareholders increased significantly, with high expectations for the company’s future profits and calls for further dividend increases.

This was despite wars, inflation, and two currency reforms. However, the present Continental Executive Board was no longer interested in using the capital market creatively. In contrast to how things were during the time of company leaders Seligmann and Tischbein, a conservative accounting mentality flourished under Chairman of the Supervisory Board Georg von Opel. In November 1958, for example, he introduced the idea of having Continental shares listed on the stock exchange in the USA. He then instructed the Executive Board to carry out the relevant audits. However, this plan failed due to numerous concerns, as did the introduction of Continental shares on the Zurich Stock Exchange a year later.

The idea of introducing employee shares was also a failure initially, before employee shares were issued for the first time in 1971 on the occasion of the 100th anniversary of the company’s founding. A big advertising campaign at the time had persuaded workers and employees to buy Continental shares at a reduced price.

The Continental share in the era of financial market capitalism: from dizzying heights to a standstill during the coronavirus crisis

From about 1983, the decline of the Continental share came to an end: it began a new life cycle, reflecting the fact that the company was largely reinventing itself. In addition, the Continental Executive Board understood the rules of the new ‘investor capitalism.’ It began to actively seek out interest from foreign investors.

In 1983, Continental returned to the group of dividend-paying German companies, also benefiting from the tailwind of the recovering global economy. All Group divisions were back in the black. The spectacular acquisitions of Uniroyal, General Tire and Semperit also contributed to this.

These financial market terms and share key figures were readily communicated by Continental’s Executive Board. Looking after investors and observing shareholder values now became central elements of targeted financial marketing at Continental. This was also reflected in the fact that Continental shares were given their own place for the first time in the annual report for 1988. As a result, regular reports were now given on the corresponding developments in the preceding financial years. Continental shares were now traded on all eight German stock exchanges at the time, as well as on four major foreign stock exchanges in Europe and had a high level of liquidity.

Despite costly attempts to sell Continental at an international level as the “most innovative partner of the automotive industry” as part of a new corporate strategy, Continental remained a potential takeover target in subsequent years.

As early as 1999, the price of Continental shares had dropped significantly as a result of a renewed crisis in the automotive industry and the associated lowering of profit forecasts by the Continental Executive Board.

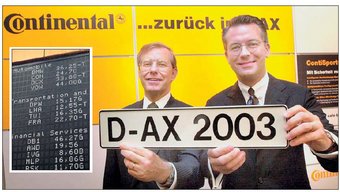

However, a development that catapulted Continental shares to new heights began in 2003, before it posted another brief slump in 2009 as a result of the global economic and financial crisis. In the eyes of Continental’s Executive Board, only now did the capital markets begin to honor the company’s new direction. After a seven-year absence, the company was again one of the TOP 30 share values in Germany. The return to the top of the stock market brought the share back to increased attention from international financial markets and global investors.

The replacement of the chairman of the Executive Board and the election of a new chairman also made a significant contribution to the positive development of the share price. The capital increase at the start of 2010 also caused sentiment to improve as a result of its successful implementation.

There were further price increases until 2015, the €200 mark was exceeded for the first time and the share price reached a new record of €230. In 2018, this was again surpassed at €257.

However, since 2016, the air has become noticeably thinner for Continental shares on their high flight – the volatility of the share price development increased significantly. Measuring the company’s success on the share price alone proved problematic – particularly in light of high expectations from investors, which the company’s performance was actually able to meet. The negative trend intensified in spring 2020 when the coronavirus pandemic caused a global stock market crash.

During this phase, speculation about a fundamental restructuring of the group, rather than profit expectations, repeatedly led to short-lived price jumps of Continental shares. However, news of billion-euro write-downs and losses had a correspondingly contrasting effect on the share price.

And still, a look back shows that patience is rewarded when it comes to the stock market: A buyer of 100 Continental shares in August 1994 at the nominal value of DM 5 and a price of 11.20 euros (converted value) would, despite all the fluctuations and three actual stock market crashes, have made just under 25,000 euros including dividend payments from the initial 1,120 euros at the end of 2017. This is despite all the fluctuations and three veritable stock exchange crashes. Even at the end of 2020, this sum still stood at around 15,000 euros.

Conclusion

The regional distribution of the free float at the end of 2019 shows that, irrespective of all the Continental share life cycles, there is a group of small shareholders who have remained loyal to the company through thick and thin.

Therefore, anyone who bought Continental shares in March 2020 (or shortly afterwards) at the low price of 55 euros per share can look forward to substantial increases in value – provided they have the necessary stamina and the capacity for suffering that is repeatedly demanded of Continental shareholders.